Disclaimer Time

We plan to use BLOCKCHAIN technology to innovate conventional investment methods, and create tools to democratize investment in compliance with regulation in Colombia, where this project is located, but not exclusive to their nationals.

We don't promise extraordinary gains, volatility or tokens that could be useful for pumps or money laundering. We don't use referral, piramidal or multilevel estructures. We are in it for the development of our country, capital is a means and a consequence.

Because land, buildings and businesses require work and are not created out of thin air like tokens, we don't give handouts AND we are not responsible if you get scammed in such schemes. Reporting any scam activity or security issue IS work and can be rewarded.

We currently don't conduct any formal business involving cryptocurrencies. When this changes we will notify our users and start complying with reporting requirements to the UIAF and related institutions according to the scope of the movements.

Decentralized Investment+Rent

You already know what ARCA means, this is the other part, our work on Decentralized Investment Access

We are developing the building blocks and compliance framework to allow Colombians (and the world) to invest and rent in local Real Estate and Business through blockchain based value and management tools.

Since regulation doesn’t provide a framework yet, we are starting with a conventional structure to experiment in bridging local law and regulations into a future DAO. Check details about our core operating fronts in the portfolio.

Not the usual

Challenges to Overcome

Our end game is offering the possibility to investors of all sizes to invest and rent from real estate + business opportunities, as easy as buying, staking and selling any other crypto asset.

In the

Local market

- Blockchain RegulationNot adverse to crypto, but there's no specific regulation to integrate it in business models like ours.

- Accounting & ManagementCurrent models and processes could hurt efficiency and decentralization.

- Tech LiteracyMost population still figuring out 1st generation crypto paradigms.

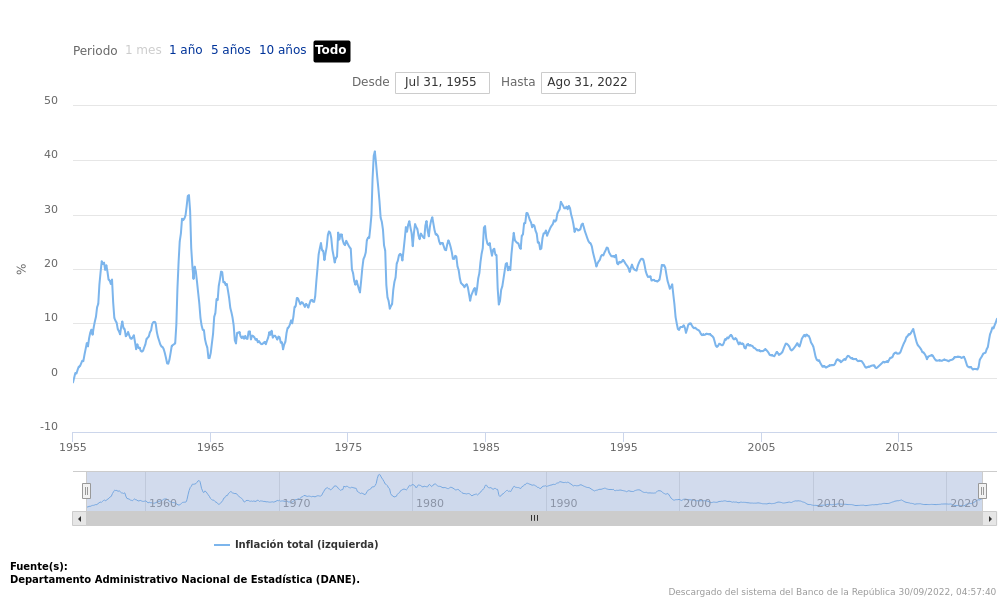

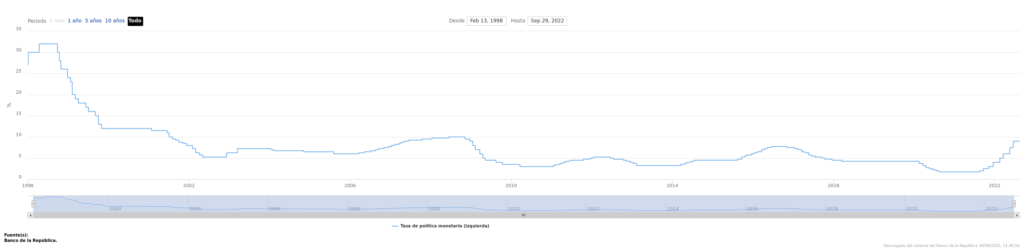

- Economy & PoliticsInflation and political uncertainties too early to start clearing.

For

Global Investors

- Quirky Foreign InvestmentWe are awkwardly friendly to FI but have no framework for crypto FI.

- Taxes & TreatiesHow to bridge crypto with the current benefits to foreign taxation.

- Country Positioning (Marketing)Not a very well known country, until recently shadowed by conflict.

- Benefits For Local ExitsHelping you get your Investor visa implies acting as 'registered agents'.

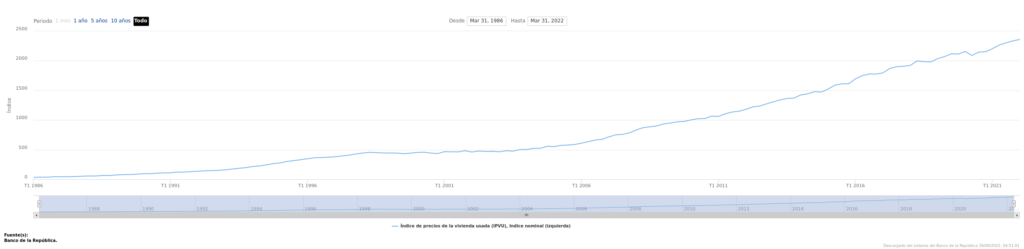

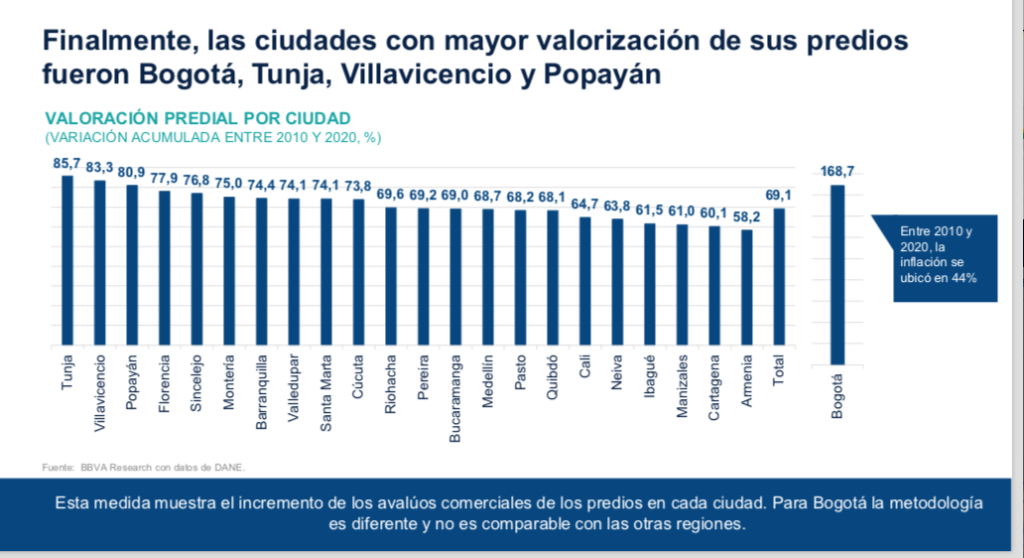

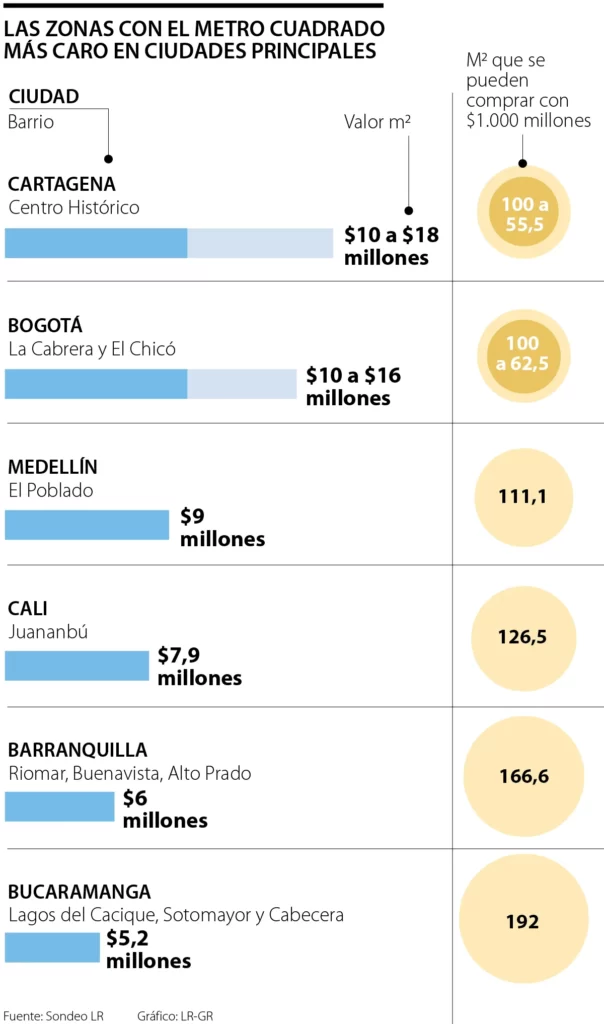

Colombia is already

A good investment destination

We just want to make it better, more accessible to starting investors, both local and foreign.

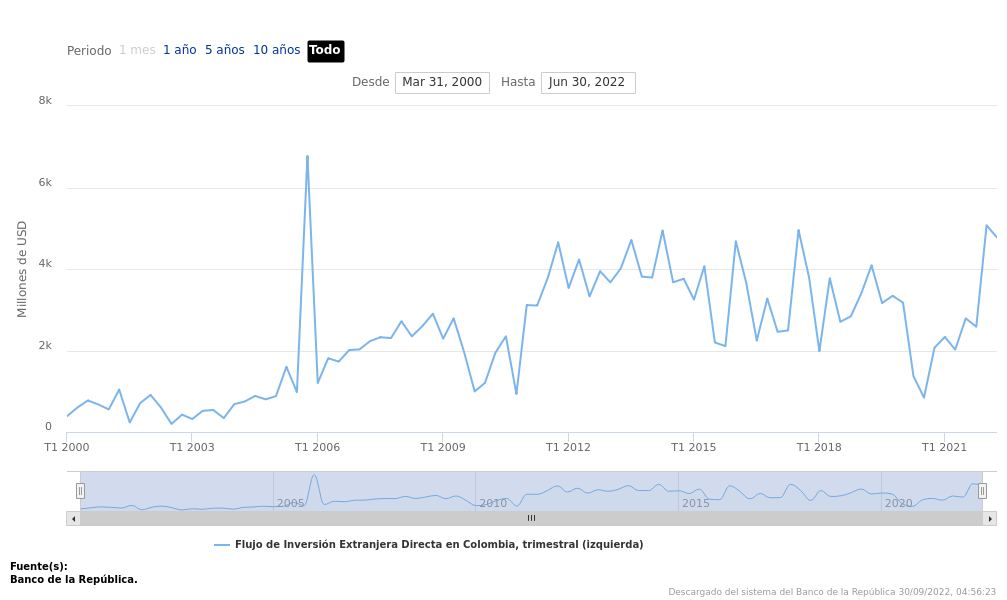

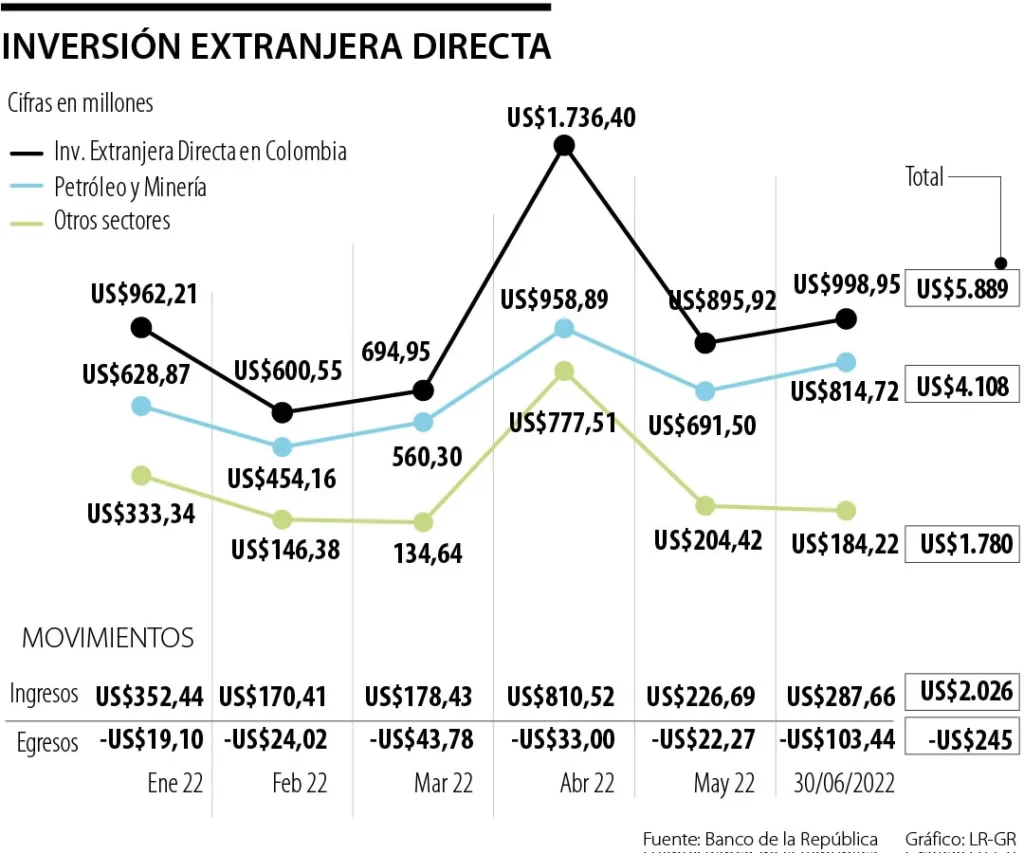

Source: WB via Trading Economics

Source: Trading Economics

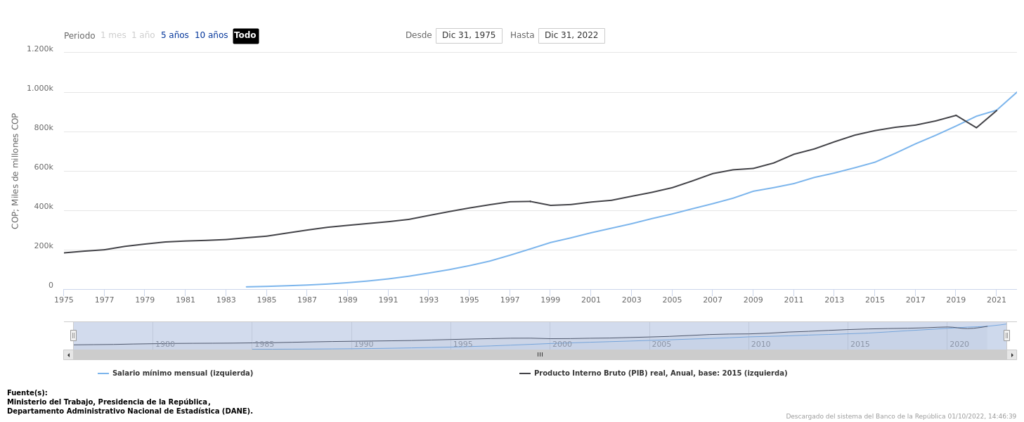

Source: BANREP

The |state| of crypto

regulation in Colombia

Solving the specific challenges of this project unlocks a huge range of opportunities of investment in the vertical and in unrelated markets. This is the core of the whitepaper we are preparing, where explaining the how is a legal and procedural exercise, rather than a coding and algorithmic one. As of October 2022 there is no single, specific, crypto regulation, different institutions address their own concerns and set their own policies.

BANREP: Cryptos are not currencies

Banco de la Republica, our FED equivalent, started addressing crypto since 2014 stating that cryptocurrencies are not actual currencies, not being backed by a government etc. Pretty much the same view of most central banks. The central points of their press releases and statemens are:

- 1Colombian peso (COP) is the only legal monetary and accounting unit in the country.

- 2Cryptoassets are not recognized as legal tender, nobody's obligated to receive them.

- 3Cryptoassets are not recognized as (foreign) currency.Hence, they can't be used in (forex) exchange operations, like registering foreign investment.

- 4Financial institutions and stock markets are not authorized to mint or sell cryptoassets.

- 5Established a workgroup to study the market and regulate as needed.

- 6BANREP joined the R3 (Corda) initiative enabling the establishment of a sandbox environment.

SFC: Regulated entities can't crypto.

Superintendencia Financiera de Colombia is our FINRA/SEC equivalent, an oversight and vigilance entity. They are in charge of setting up the sandbox for evaluating blockchain based business in the context of a future specific regulation, works more or less like a waiver.

- 1Supervised Entities (SEs) can't hold, invest, intermediate, or operate with crypto assets.Neither allowed to use their platforms for operations related with them.

- 2"Electronic coins, crypto coins or virtual coins" are not securities.Not part of the local stock market, not a valid investment for SEs which can't advise or operate on them.

- 3SEs can't offer custody, invest, intermediate, or operate with "Virtual Coin Systems"Same as the first one but geared toward some pyramidal schemes and other informal investments

- 4Statements to the public with generic warnings and precautions, some quotes:

- 4.1"their acceptance is very limited"

- 4.2"They are not backed by tangible assets"

- 4.3"Exchanges are not regulated by local law"They are now at least in the sandbox, exchanges informed the users.

- 4.4"operational risks like virtual account stealing"

- 4.5"they are not backed by any private or state warranty"What is a smart contract. And no warranty from the state is the original POC of crypto anyway.

- 4.6"transactions are anonymous"

DIAN: Crypto pay taxes like any other capital gain

Dirección de Aduanas e Impuestos Nacionales is our IRS equivalent, like many others started to pay attention in 2017. Their positions are based on the 2014 FATF document and not much different from most taxation opinions regarding cryptocurrencies. But they only address this scenario and not all the other types of crypto assets. AML is though due to WoD and preventing the missuse of what we develop should be baked in the fundamentals.

- 1Is not clear if they think a "bitcoin" is a phisical coin with a "virtual representation"That only works when is connected to the internet

- 2Crypto mining might creates estate and produces rent, at the very least, is providing a service.

CTCP: We can't clasify this, checks too many boxes.

Translated Technical Council of Public Accounting dictates the standards by which companies should report their numbers. They are implementing the NIIF standard and base their points on that, which doesn't provide specific guidelines for crypto assets. These views apply mostly to handling crypto in business accounting.

- 1Policies for one type of CA might not work for another.accountants should evaluate each asset

- 2Cryptoassets meet the definition of assets.

- 3Not FIAT or FIAT equivalent

- 4Like gold bullion, it may be liquid but no contractual value so is not a financial instrument

- 5A cryptocoin can't be classified as an investment property.

- 6They are an intangible asset as long as there is an active market.

- 7CA commerce can be treated like listed raw materials exchange.

Sources:

The info in this regulation summary is taken from the “Documento Técnico Cryptomonedas” which is published by BANREP and compiles a unified stance based on the multiple sources and opinions in the matter. The document also includes an overview and comparison with regulation in other countries, mostly in the region. [PDF]

Inviting angels and VCs to manifest their interest in becoming Internal Investors.

Before we are able to request funding for our RE projects, we need to fund our initial operations and staff. As you may have noticed, this is a project in which the legal and procedural should be the main focus at first, rather than a technical development. We can’t do the later if the former is not solid.

Internal investors are selected based on their experience and affinity with our project’s environment and goals. Market cap and funding objectives are modest so tickets might be limited. That’s why we think in the founders’ potential for advising and execution as a multiplier in relation to the size of their investment. Please use our Whitelisting form to let us know your interest.

Contact Hub

Choose your destination

We can take you lots of different places depending on what you are looking for. Please use this tool to find the right gate for your inquiries.

For local inquiries perhaps the phones are the quickest way to get there.

International

US - New York

Local

CO - Bogotá DC

Otherwise, please click or tap on one of the options below.

Coaching and Consulting

Detailed Realty requests

B2B services and Startups

Investor whitelisting and KYC

Real Estate

Detailed request and inquiries.

Buying or selling RE in Colombia? Use this form for sharing your property's details or requirements.

The price if you are selling. or the budget if you are buying.

Specify the area in square meters.

Specify the city or region of your interest.

Describe fully your property if you are selling. Or specify any detail of what you are looking to buy.

Add any relevant photos or plans.

JPG or PNG | Max 2 files x 4 Mb

Check to restrict your data to internal agents.

Please rate from 0 to 10 how important are these features to your property or plans:

Thats it! Now please continue to the next step to share your contact info. Don't worry, is the last step.

Studio

Requests from businesses and entrepreneurs.

If you are here is because you are either a business trying to sell more, or an entrepreneur trying to sell us their business idea.

This form works for both but is focused on the later, the former is perhaps better served calling us directly, especially if reaching from LatAm.

What your company does, in tweet form. 140-300 chars

Links

Link your LI profile or CV pdf.

PDF preferred

Main social if you don't have one

Describe in detail your idea or established business. Describe your challenges and opportunities, and how can we benefit together.

Check any service that you might require.

Thats it! Now please continue to the next step to share your contact info. Don't worry, is the last step.

Coaching & Consulting

Private, personalized, and contextualized.

Se de los primeros en acceder a este servicio experimental. Agenda una consulta privada o clase personalizada con nuestro equipo C acerca de cualquier cosa en tecnología.

This service is currently available for LatAm customers only.Qué sientes que tu o tú empresa necesitan para aprovechar correctamente las nuevas tecnologías.

Red social principal, en caso de no contar con uno.

Link a tu perfil de linkedIn o un CV para descargar.

Selecciona los temas sobre los que te interesa tener fundamentos claros.

No todo se puede aprender en una clase, pero tener un panorama amplio nos ayuda a estructurar un proceso, si hace falta.

Reserva fecha y hora para la reunión.

¡Eso es todo! Ahora por favor continúa al siguiente paso para dejar tu info de contacto. No te preocupes, es el último paso.

Whitelisting

Internal Investors

Compliance and easy onboarding requires us to know a bit about you. This keeps everyone safe and prevent you from facing unexpected restrictions later in the process.

This form allows you to add the basic documentation required in any KYC process, this way, once whitelisted, you can start participating in our development.

No SSNs

Links to your Angel, VC or Crypto profiles. LinkedIn also helps. Optionally, describe how your profile matches our project and what can you bring to the party..

2 Photos of your passport: 1 with legible photo and text, and 1 selfie you holding it below your face.

JPG or PNG | Max 2 files x 4 Mb

Add any address that you want us to whitelist so we can internally link them to your ID right away. Don't worry, all your info is kept private, easily manageable, and is not used directly on this site, or feed to 3rd parties.

Check to let us know if you are a holder in any of your addresses.

We are not requiring or requesting any TX for confirmation.

Any TX should be considered a donation, or a grant.

Thats it! Now please continue to the next step to share your contact info. Don't worry, is the last step.

Contact Info

Let us know how to get back to you.

I've read and accept the P.P.

Personal Data Handling Authorization

Don't miss any updates

Verify Your Info

| Field | Data | Values | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

*Whitelist and DLT participation*

Eligibility is subject to regional laws and regulations. ARCADIA's future blockchain developments can be offered only to persons, aged 18 years or older, or entities who are not residents of, citizens of, are incorporated in, or have a registered office in any “Restricted Territory.” The term Restricted Territory includes the United States of America* (including its territories), Algeria, Bangladesh, Bolivia, Belarus, Myanmar (Burma), Côte d’Ivoire (Ivory Coast), Egypt, Republic of Crimea, Cuba, Democratic Republic of the Congo, Iran, Iraq, Liberia, Libya, Mali, Morocco, Nepal, North Korea, Oman, Qatar, Somalia, Sudan, Syria, Tunisia, Venezuela, Yemen, Zimbabwe, or any jurisdictions in which the handling of cryptocurrencies are prohibited, restricted or unauthorized in any form or manner whether in full or in part under the laws, regulatory requirements or rules in such jurisdiction, or any state, country, or region that is subject to sanctions enforced by the United States such as the Specially Designed Nationals and Blocked Persons List (“SDN List”) and Consolidated Sanctions List (“Non-SDN Lists”), the United Kingdom, or the European Union.

* US nationals are cleared for direct investment in Colombia, anti-double taxation treaty is in place.